This post may contain affiliate links. Please read my disclosure for more info.

If you want your financial life to change, you got to put in the work. Since accomplishing my goal of becoming a CRNA, I have really buckled down on paying off debt by finding a budget that works for me. Fast forward to today. In addition to successfully paying off close to $20,000 in credit card debt, I have also been able to finally get control of my finances. Read the steps I took to pay off my credit card debt.

I went a step further and started using cash envelopes early last year. And I am glad I did. It has definitely changed my budget and how I look at money. An all-cash spending method in addition to a budget was all I needed to get me one step closer to financial freedom.

So, I want to focus on the cash envelope system today. I want to show you how to use your cash instead of your debit card. I have included some great resources as well to get you started.

What is the cash envelope system

Basically, the cash envelope system is a simple way to divide your cash into categories. It forces you to use the cash you have on hand. This system involves putting actual cash into designated envelopes which allows you to track your spending and stay organized.

Each category has its own separate budget and envelope to keep you on track and organized. This has several benefits. First, this prevents you from spending more than you have set for this specific category (example- eating out). This allows you to stay within your preset budget each month.

The mindset to get started

One might argue it should be easy to get your finances in order if you are already a CRNA. I beg to differ. It can actually be just as overwhelming when you look at the debt accumulated trying to accomplish such a feat.

Just like with anything new you may feel overwhelmed or even confused when first starting the cash envelope system. But just like with anything in life, as you do it more you feel more comfortable with it.

So don’t give up. Keep moving on! I try to use my cash envelopes every time I get paid but sometimes things come up. This is ok! It takes time to get a new routine down but it will become second nature soon!

Now your mind is right but there is something else you need to do, first…

You need to get a budget in place. I know exactly how you feel. Who has the time or wants to create a budget? Take my word for it. Once you do set a budget, it will make the cash envelope system go more smoothly.

So who is ready to say goodbye to reckless spending? Let’s get your cash envelope system started right now!

Create your budget

As I mentioned earlier, you must have a budget in place in order for the cash envelope system to work. So if you haven’t created a budget the time is now. It may take some time but it’s well worth it.

Here are some helpful resources from my favorite blog, The Budget Mom, to begin creating a budget today:

• How to Make a Realistic Budget That Actually Works

• My 15-Minute Budgeting Routine

• How to Start a Budget When You Live Paycheck to Paycheck

Now let’s get back to the steps you will need in order to start your cash envelope system

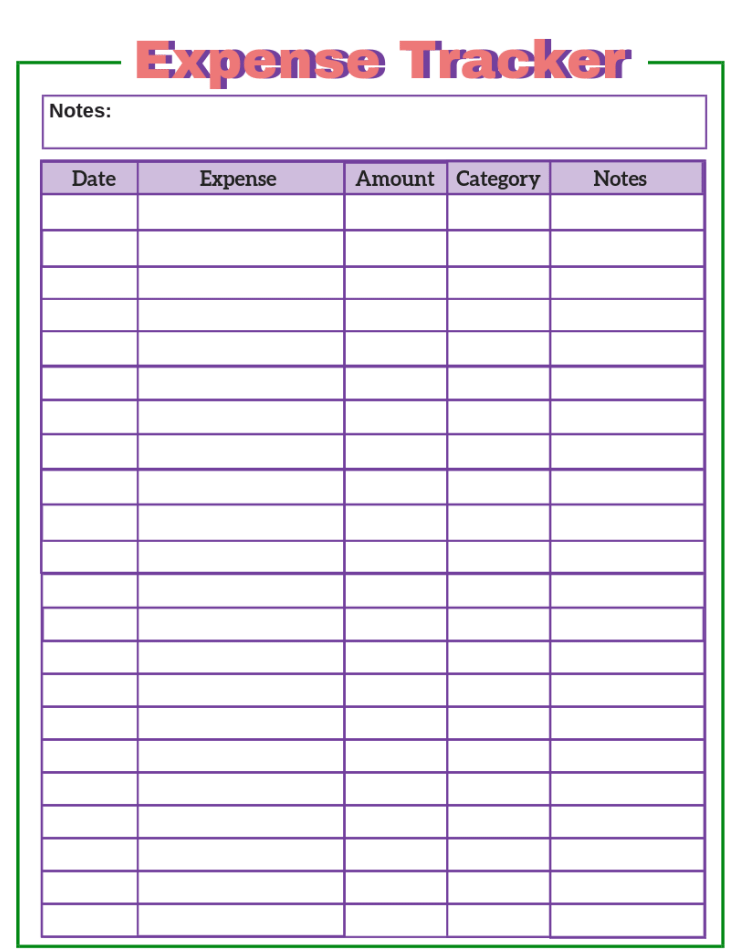

Track what you spend

In order to properly use the cash envelope system, you must know exactly where your money goes each month. This information is necessary to properly know which categories to place your cash in order to spend.

I must admit I didn’t put pen to paper to track my expenses when I first started out seeking financial freedom. But I did keep my receipts and analyzed my bank statements. As a result, it took me a little longer to figure out exactly the right amount to place in each category.

Define categories for spending

In addition to creating a budget, you must also choose the right budget categories for your envelopes. If you choose too many categories you will not see any improvements in your budget. This is why tracking your spending is critical in order to get this step right.

So, whip out the budget you created earlier. Looking at the budget, cross off all fixed expenses. For example, your car payment will likely always be $300 month. Your internet will always be $58 a month. These expenses likely will not change, in most cases.

Examples of fixed expenses:

• Rent/ mortgage

• Internet/cable

• Subscriptions

• Daycare.

• Car payment

These items are not good candidates for cash envelopes because they remain constant regardless.

What are your problem categories

Now all the categories left over should be your variable expenses. Variable expenses are simply those expenses that change from month to month depending on your wants and needs. These expenses also tend to be your problem categories. These categories also may leave you feeling guilty like when you see how much you spent on clothes.

These are the categories you want to pick for your cash envelopes. If you still have no idea which categories to pick, here are some suggestions:

• Food

• Groceries

• Clothes

• Miscellaneous

• Fun

• Beauty

Now that you know where your problem areas lie, select your top 5- 7 problem areas. These would be ones in which you overspend the most. I think starting out with five cash envelopes is more manageable and not as overwhelming.

Choosing limits for each category

Once you have tracked your spending, figured out the categories, the next step is to set limits for each category. These limits are set based on what you learned when you tracked your spending. You did track your spending, right?

Now determine what the cash value will be for each envelope. Remember, you can change this value as you go. Actually, every time you create a budget you need to update your limits accordingly.

The cash value you set for your categories must be within your budget! Whenever I budget my paycheck, I determine the limits for my envelopes right then.

Time to make cash envelopes

By now I am pretty sure you know I love following my cash envelope system. It has allowed me to get ahead of my spending.

Like most things in my life, once I get my mind set on something I go full force. So once I decided the cash envelope system was for me, I did the research to find out how to get some. Of course, there are many different ways to make your own cash envelopes. I started out with some regular white envelopes from the store which is totally fine.

But I quickly realized I needed something a little more visual and prettier.

I ditched those white envelopes and now make my own envelopes using scrapbook paper along with a printable template. It’s actually fun and therapeutic for me. You may find you like it as well. But if you don’t care to make your own, I’m pretty sure you can purchase one of these cash envelopes and it will also work for you:

•TBM Botanical Cash Envelope System

• Reusable plastic Cash Envelope system with snap button

• Dave Ramsey Blue Starter Envelope System: Financial Peace University

Now add cash to your envelopes

I am a Budget by Paycheck kind of girl, which means I budget and stuff my envelopes based on when I actually get paid. My paydays are typically around the 5th and 19th of every month. I pay all my fixed bills online and then and only then do I go to the bank to withdraw cash to stuff my envelopes. So I only stuff my envelopes twice a month.

After you figure out how much to allocate for each cash envelope, it’s time to stuff your envelopes with the money you withdrew from the bank. This is actually a lot of fun in my opinion!

For example, I budget $280 for eating out/ groceries, so I put $280 in the “Food” envelope. You need to do the same for each category.

Only use money for that specific category

Listen up! This is very important.

In order for the cash envelope system to work, you must be careful about stealing money from other categories.

If you find you are taking money from other envelopes to buy your groceries, then you may need to rethink how much you have budgeted for that category. This is an indication you just need to readjust your budget. No big deal. Make the change and see how it works next time.

Helpful cash envelope tips

#1: Are you still trying to figure out which categories to choose? Choose the categories you struggle with the most.

For instance, I struggled with my food budget. I started out with an eating out category in addition to grocery. I have since combined them together because I noticed I was eating out too much. And combining them both has helped prevent me from overspending.

#2: What if I need to purchase something online? Yes, I struggle in this area also. I have heard some really good ideas on how to approach this.

One way is to create another envelope labeled “online spending”. Any time you make an online purchase, you would take cash out of that envelope and put it into the “online spending” envelope. You could either put it in the bank to cover the “online spending” item or use it to fund your next round of envelopes.

I personally put the money back in the bank because I try to make sure every dollar has a place in my budget. This is called zero-based budgeting. Read more about it here.

#3: This leads to my last tip… When using the cash envelope system your bank account may be low at times. This is not a bad thing actually. Remember using a zero-based budget allocates every dollar you have to a category.

The one thing I would do is keep extra money in your checking account at all times to prevent those dreaded overdraft fees.

My goal is to keep an extra $500 in my checking account in case there is an unexpected bill. So, starting with my next paycheck the plan is to allocate $50 from each paycheck to cushion my checking account. The key is to never withdraw that money and just let it accumulate. Sounds easy, right?

Essential steps to get started using the cash envelope system

• Have the right mindset

• Create your budget

• Track your spending

• Define categories

• Set limits for each category

• Add cash to envelopes

• Only use money for the specified category

So now you are all set and ready to start using your cash envelope system. Again remember to create your budget first. Also, track your spending.

By using the cash envelope system you will notice how quickly your spending habits change. This new way of approaching your finances will take time and patience. But, I really believe this system will help you get control of your finances and lead you to financial freedom. Also if you desire to become a CRNA, I feel strongly about helping you get there. So, be sure to download my Future CRNA Action Plan.

So, take your time. Do the research. But, get started today!